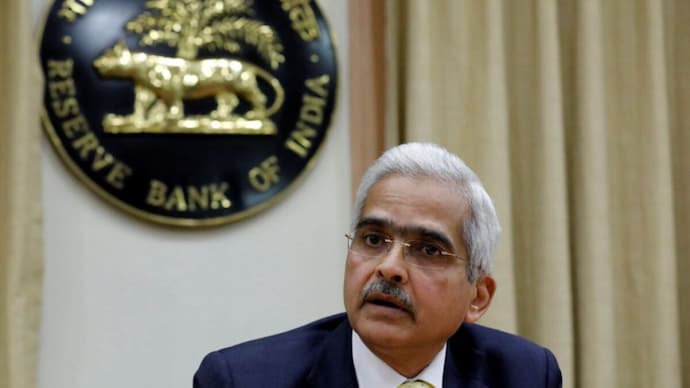

New Delhi: On Friday, Reserve Bank of India (RBI) Governor Shaktikanta Das said that the Reserve Bank of India (RBI) kept the repo rate unchanged for the fifth time in a row as the monetary policy committee maintained a status quo. The decision is broadly in line with what economists had expected.

In a statement, RBI Governor Shaktikanta Das said, “…The Monetary Policy Committee decided unanimously to keep the policy repo rate unchanged at 6.5%. Consequently, the Standing Deposit Facility rate remains at 6.25% and the Marginal Standing Facility rate and the Bank Rate at 6.75%.”

On Wednesday,The three-day bi-monthly monetary policy committee (MPC) meeting of the RBI began. The decision to maintain the key repo rate at 6.5 percent marks the fifth instance when the 6-member Monetary Policy Committee (MPC) has opted to keep the interest rates unchanged.

Das furter said that 5 out of the 6 MPC members decided to keep the focus on “Withdrawal of Accommodation” to ensure that inflation progressively aligns with the target (of 4 per cent) while supporting growth. The RBI generally holds six bi-monthly meetings in a financial year, where it deliberates on interest rates, money supply, inflation outlook and various macroeconomic indicators.

The RBI Governor highlighted that easing inflation across all components of retail inflation is one of the reasons behind the MPC’s decision to keep the repo rate unchanged.For the fourth straight occasion, the monetary policy committee, through its October review meeting, unanimously decided to keep the policy repo rate unchanged at 6.5 per cent, thus maintaining the status quo.

He also said “There has been broad-based easing in core inflation, which is indicative of successful disinflation through monetary policy actions,” he said In its past four meetings, it held the repo rate unchanged at 6.5 per cent. The repo rate is the rate of interest at which RBI lends to other banks.

In October,While deliberating the policy statement, RBI Governor Shaktikanta Das said the central bank was concerned and it had identified high inflation as a major risk to macro-economic stability and sustainable growth. However, He highlighted that the near-term inflation outlook is “masked” by risks to food inflation, which may lead to an uptick in November and December. “This needs to be watched for second-round effects, if any,” he added.

Das had reiterated that the monetary policy committee is committed to aligning India’s headline inflation at 4 per cent level. Governor Das also highlighted that the country’s domestic activity is “holding up well”, as reflected in the GDP growth for the second quarter of the ongoing financial year.

In his statement, Das said,”Against this backdrop, the MPC decided to keep the policy repo rate unchanged at 6.5 per cent, but remain highly alert and prepared to undertake appropriate policy actions, as warranted.” Retail inflation in India continued to ease through October, supported by a relative decline in some of the sub-indexes. The October consumer price index (CPI) came at a four-month low of 4.87 per cent against 5.02 per cent the previous month.