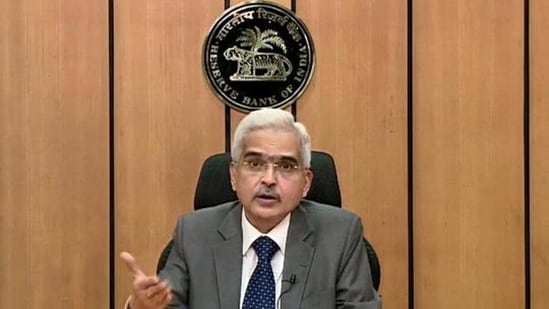

New Delhi: On Thursday, The monetary policy committe led by Shaktikanta Das has kept the repo rates unchanged at 6.50 per cent for the sixth straight time. The decision has been taken with 5 members in favour of the decision out of the total 6.

Consumer Price Index (CPI) inflation, or retail inflation, increased, reaching a four-month high of 5.69 per cent in December. The RBI has kept the FY24 GDP projection unchanged at 7 per cent. It has also kept inflation forecast unchanged at 5.4 per cent for 2023-24.

The policy stance continues to be ‘withdrawal of accommodation’. The increase was primarily attributed to the elevated prices of various food items, including pulses, spices, fruits, and vegetables. Comparatively, in November 2023, CPI inflation stood at 5.55 percent.

The SDF is the lower band of the interest rate corridor, while the MSF is the upper band. Despite this recent rise, headline inflation has managed to fall within the 2-6 percent range stipulated by the government for the Reserve Bank of India (RBI).

However, it still exceeds the central bank’s target of 4 percent. RBI Governor Shaktikanta Das on Thursday said, Presenting the sixth and last bi-monthly monetary policy of FY24, “Inflation is on a downward trajectory. Our multipronged policies have worked well to keep the financial system stable.”

He said ongoing wars, and new flashpoints including the Red Sea crisis impart uncertainty to the global outlook, and monetary policy continues to be actively disinflationary.The RBI has projected CPI inflation for the fiscal year 2023-24 (FY24) at 5.4 percent, with expectations of 5.6 percent for the third quarter (Q3) and 5.2 percent for the fourth quarter (Q4). These projections indicate a cautious outlook on inflationary pressures, despite the recent fluctuation