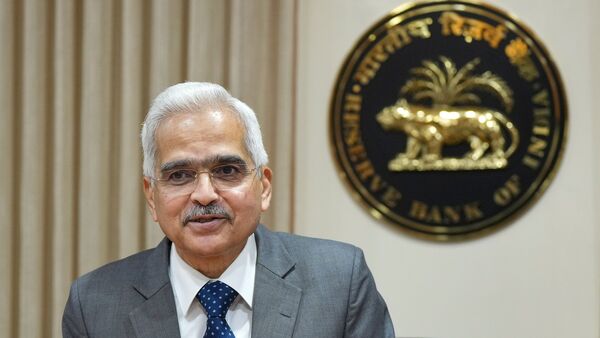

New Delhi: On Friday, The Monetary Policy Committee (MPC) has decided to keep the repo rate steady at 6.5% for the seventh consecutive time. According the the statement by India’s central bank, the decision was made on a majority of 5:1. RBI Governor Shaktikanta Das said the MPC voted in favour of keeping key lending rates unchanged.

Das said,”After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the Reserve Bank MPC decided by a majority of 5 to 1 to keep the policy repo rate unchanged at 6.50%.” The Standing Deposit Facility (SDF) rate remains at 6.25%, while the Marginal Standing Facility (MSF) rate and Bank Rate stand at 6.75%.

In his monetary policy statement, Das said that the priority of monetary policy remains achieving the 4% inflation target amid strong growth. He also highlighted the need for monetary policy to maintain an actively disinflationary stance at this stage. RBI Governor Shaktikanta Das elaborated on the decision, stating that inflation has decreased from its peak of 5.7%.

He noted favorable growth-inflation dynamics and a steady decline in core inflation, reaching its lowest point in nine months. Despite volatile food inflation in February, core inflation, excluding food and fuel, has shown a downward trend. Concerns remain regarding the impact of weather variations on inflation and economic stability.

RBI Governor said that GDP growth is expected to be 7% in FY 25. RBI Governor said that demand is getting stronger in the rural sector. At the same time, private consumption is also expected to increase.

He said that the GDP growth estimate for the second quarter of the financial year 2024-25 has been increased from 6.8% to 6.9%. Finance Minister Nirmala Sitharaman expressed optimism about the economy, citing GDP growth exceeding 8% for the first three quarters of FY24. India recorded robust economic growth of 8.4% in the December quarter of fiscal 2023–24, with upward revisions in GDP estimates for preceding quarters by the National Statistical Office (NSO).

.